LONDON (MarketWatch) — Now this is Greek tragedy.

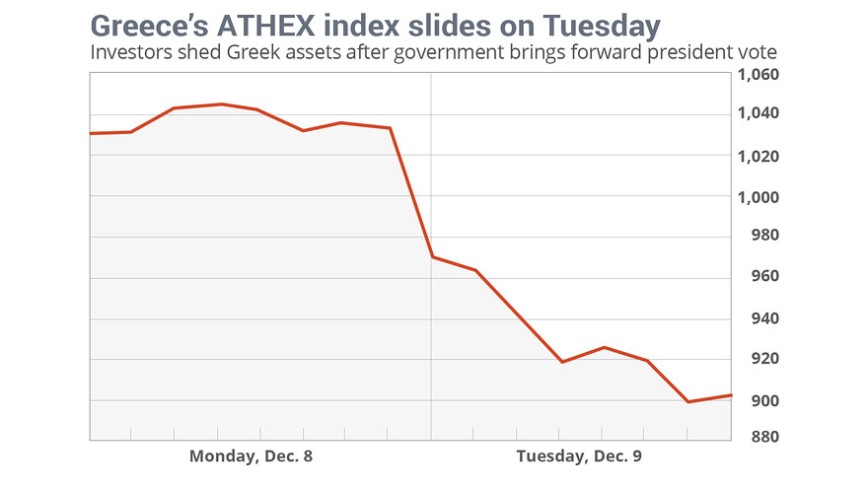

Greece’s Athex Composite GD, -12.78% tanked almost 13% Tuesday — the biggest drop for the index on record, according to FactSet. The renewed jitters came after the government, in a surprise move late Monday, said it would bring forward presidential elections to Dec. 17, potentially, setting the scene for snap elections in early 2015.

Here’s why that’s important: Far-left party Syriza currently is leading the early polls and it seems likely they would win a snap election. This is how to think about Syriza:

- The party has been calling for an end to austerity in Greece

- Has been campaigning for market-unfriendly measures

- Is firmly against the international bailout program that helped the country avoid a default during the depths of its financial crisis.

How bad is Greece’s Tuesday collapse? It’s worse than the 9.7% drop the market saw Oct. 24, 2010, at the peak of Greek debt worries. The drop also eclipses the 10% fall Greek markets saw in 1989 during a bout of political turmoil.

“If there is uncertainty about Greece’s political commitment to the bailout program, it seems likely that the QE opposition within the ECB has some temporary tailwinds,” analysts at RBC Capital Markets said in a note. “If that is the case, the [ECB] January meeting (due on 22 January) could be a quite contentious one, and the ECB might choose to wait until after the elections in Greece to decide further measures.”

With Greece’s problems once again in the limelight, investors all across Europe. the Stoxx Europe 600 index SXXP, -2.33% slumped 2.3%, while Germany’s DAX 30 index DAX, -2.21% fell 2.2% and France’s CAC 40 index PX1, -2.55% gave up 2.5%.

Greek government bond yields GR10YT, +0.00% jumped 75 basis point to 7.90%, according to electronic trading platform Tradeweb.