The 3rd Infantry’s 1st Brigade is for combat. It’s not the National Guard or local police. It’s trained for war. “Equipped to kill people” with potent weapons, and a last hurrah scheme may be planned to divert public attention from the financial crisis. A “terrorist” attack with “chemical, biological” or other dangerous weapons. A possible pretext for martial law at a time the administration and Congress are vulnerable. When people are angry about Washington protecting the privileged. Partnering with them in crime. Defrauding the public and stifling dissent. Moving one step closer to tyranny and away from silly notions about democracy. Proving crime indeed does pay and awfully well on Wall Street. “It’s the economy, stupid.” Theirs, not ours. – Stephen Lendman

by Stephen Lendman

World Prout Assembly

September 29, 2008

09/29/08 – “WPA” – The crime of the century. The greatest one ever. Author Danny Schechter calls it “Plunder.” The title of his important new book on the subprime and overall financial crisis. Economist Michael Hudson and others refer to a kleptocracy. A Ponzi scheme writ large. Maybe an out-of-control Andromeda Strain. An economic one. Deadly. Unrecallable. Science fiction now real life. Potentially catastrophic. World governments trying to contain it. Trying everything but not sure what can work. Maybe only able to paper it over for short-term relief. Buy time but in the end vindicate the maxim that things that can’t go on forever, won’t.

The world as we know it is changing. Industrial capitalism. The entire global economic system. Interconnected. What affects one nation touches others. If the troubled country is America it reaches everywhere, and if the crisis is great enough, the disease may be fatal and human wreckage catastrophic. Precisely the current dilemma that world leaders and financial experts are scrambling to figure out. Desperate to contain, and not sure what, if anything, can work. How did this happen and why?

The result of unfettered capitalism’s fatal flaw – unbridled greed in a rigged system that rewards the few at the expense of most others. First an explanation of how it works. Free-wheeling, “free market” Chicago School fundamentalism the way economist Milton Friedman championed it in his 1962 book “Capitalism and Freedom” and taught it to students for decades. He believed that government’s sole function is “to protect our freedom both from (outside) enemies….and from our fellow-citizens.” Preserve law and order. Enforce private contracts. Protect private property and “foster competitive (unregulated) markets.” Everything else in public hands is “socialism….blasphemy.” Not to be tolerated.

He said “free markets” work best. Unfettered by rules, regulations, onerous taxes or any at all, trade barriers, entrenched interests, and human interference. That anything government does, business does better, so let it. That the best government is one that governs least. That public wealth should be in private hands. The accumulation of profits unrestrained. Corporate taxes abolished. Social services also, and that “economic freedom is an end to itself….and an indispensable means toward (achieving) political freedom.”

He called most all government interference a restriction of freedom. Opposed foreign aid. Subsidies. Import quotas and tariffs, and illicit drug laws for being a subsidy to organized crime, but he found no fault with major banks laundering their profits. He believed business should be unrestrained in maximizing them, even the illegal kind apparently.

He opposed the minimum wage and right of unions to bargain collectively on equal terms with management. He believed high wages and benefits harm everyone. They raise prices, and in the end, hurt workers as well as management. He called Social Security “The Biggest Ponzi Scheme on Earth,” even though it’s been the most effective poverty reduction program ever for millions of seniors who’d be desperate without it. Especially today given a deepening economic crisis. The nation’s social safety net disappearing, and heading everyone toward managing on his or her own. Dependent on their ingenuity, resources, and good fortune. Milton Friedman’s ideal world. For those who can’t make it, it’s their own fault. It’s everyone for him or herself in his judgment, and let the devil take the hindmost.

As for today’s largest ever unraveling Ponzi scheme, it’s just the workings of the “free market.” Creative destruction. “Freedom to choose.” The best of all possible worlds, and unfettered capitalism will figure out the right solutions. Provided government gets out of the way and gives it free reign. Free money also to wreck world economies and human lives even more than what’s already done.

The Chickens Are Home to Roost

Are they ever, and here’s what we’ve got. A global asset bubble. A predictable crisis allowed to build and mushroom. Begun after Chicago School economics took hold under Ronald Reagan. Continued under GHW Bush. Became religion under Bill Clinton, and ultimately fundamentalism under GW Bush.

The result – a “slow motion train wreck” gaining speed. Banks and other financial institutions failing globally. On September 25, the largest bank failure in US history with Washington Mutual’s collapse. Earlier it was giant insurer AIG. Before that Fannie Mae and Freddie Mac, Lehman Brothers, Bear Stearns, and Merrill Lynch a forced liquidation to Bank of America.

Others are now teetering on the edge. Strapped by toxic debt. The result of out-of-control greed for easy profits. Massive fraud to get them. Thinking they’re the best and brightest, and only mere mortals mess up. Knowing Fed moral hazard will cushion them if they do. True for some. Not for others, and learning that the Federal Reserve (the world’s key central bank) failed in its primary job. To protect the country’s financial system from insolvency. By contributing to a financial crisis and one of confidence. By creating near-limitless amounts of capital. Fueling a housing bubble. Outsized consumer debt, and irresponsible investments free from government oversight. Fraudulent ones involving multi-trillions of dollars.

Partnering with government to make it easy. Risking a global economic meltdown as a result. Scrambling to find solutions. Unsure if there are any. The present crisis is unparalled. Maybe it can be fixed, and maybe not. The problem is multi-fold. A perfect storm involving:

— residential housing;

— commercial real estate;

— consumer over-indebtedness;

— unknown amounts of toxic debt (in the multi-trillions);

— affecting world finance and economies;

— causing bankruptcies;

— many more will follow;

— selected ones bailed out;

— the entire system endangered;

— consumer money market, bank accounts and private pension funds as well; government backing is needed to protect them; there’s not enough money to do it; and

— the contagion is spreading; threatening world economies and people everywhere.

This time is really different. A $700 billion bailout (called the Emergency Economic Stabilization Act of 2008 – EESA) is just a down payment. Trillions will be needed in the end. Other nations contributing to help. The problems are deeper and more intractable than anyone expected. Before this ends, unimaginable amounts of capital will be written off. Too much to even contemplate. Bad investments contaminating good ones. Threatening world financial structures with paralysis. Severe economic damage to their economies as a result.

Eroding industrial capitalism as we know it. At best managing a short-term fix and delaying a final denouement for a later time. Under new management with the current and past ones claiming no responsibility. And unmindful of millions of homeowners facing foreclosure and bankruptcy. One in ten currently behind in their payments. Others losing their jobs and way of life. They’re the most vulnerable. Least able to cope, and for some their ability to survive.

According to The New York Times, here’s how the Paulson scheme helps them: “it requires the government to use its new role as owner of distressed mortgage-backed securities to make ‘more aggressive’ efforts to prevent home foreclosures.” Weasel words. No specifics. No assurances, and nothing apparently for homeowners already in foreclosure.

On September 22, ahead of the announced agreement, American Research Group (ASG) published its latest public sentiment poll results, and they were stunning. At 19%, George Bush scored lowest ever for a US president, surpassing Harry Truman at the depth of the Korean War and Richard Nixon during Watergate. It came at a time ASG’s results showed 82% of Americans believe the economy is getting worse, and only 17% approve of how Bush is handling it. Among registered voters, the number is 18% at a time no one surveyed (zero percent) said the economy is improving and 68% say it’s in recession. True or false, it’s how they feel. How the crisis affects them, and that’s what counts most.

Yet on September 24, the president addressed the nation audaciously. Callously dismissing public pain and anger. Deceitfully stating outright lies. A typical performance. Demanded that Congress give the treasury secretary carte blanche authority over $700 billion to address “a serious financial crisis.” Asked taxpayers to pay for corporate fraud. Reward criminals and ignore their crimes. Said nothing about the root cause. The effect on ordinary people, or how Paulson’s scheme will help them. Ignored growing public opposition. Large numbers of credible observers believing the proposed solution is worse than the problem. The most honest of them saying it will enrich fraudsters and offer no help for homeowners.

Yet Bush concluded that “democratic capitalism (is the) best system the world has ever devised” in spite of clear evidence that it’s broken and corrupted. Exploits people for profit. Enriches the few at the expense of the many. Rewards criminals for their crimes. Protects the rich from beneficial social change.

Ahead of the president’s address on September 24, The New York Times showed a rare display of candor in a critical Timothy Egan opinion piece. About “nearly nationalizing the banking system and giving the treasury secretary more power than a king….whose decisions may not be reviewed by any court of law or any administrative agency.” He asked readers to remember “where the biggest heist took place, and how Wall Street dragged down the rest of the country once before,” referring to the Great Depression but leaving out everything in between.

He stressed, however, “how Wall Street brought down main street,” and things have now come full circle. Deregulation unleashed casino capitalism, and bankers made a killing. Now they’re in trouble and Bush demands “the biggest bailout in American history….or the world will crumble. He said the a similar thing in the run-up to war” so who can believe him now. Egan quotes a dirt farmer asking why not the same “concerns (for) average Americans.” Because “we the people” Bush speaks for are them, not us.

As for Paulson’s plan, here’s what the Financial Times writer Martin Wolf said on September 23. He called it “not a true solution to the crisis.” It doesn’t address the “fundamental problem.” It’s “neither a necessary nor an efficient solution. It is not necessary because the (Fed can) manage illiquidity through its many lender-of-last resort operations. It is not efficient because it can only deal with insolvency by buying bad assets (overpriced junk) at far above their true value, thereby guaranteeing big losses for taxpayers and providing an open-ended bail-out to the most irresponsible investors.”

Wolf also objects to Paulson getting unchecked powers. Providing little or no help to the poor and “ill-informed” (read duped) borrowers, and lists other operational suggestions “essential for the long-run health of any financial system” without needing “a penny of public money.” Among them, forcing creditors to take losses and not taxpayers.

Unmentioned in his article is the underlying fraud behind the crisis and a lack of regulatory oversight that made it easy. Also, omitted was what’s covered in the section below.

The 1937 Housing Act’s Empowering Section 8 Authority

One Section 8 sentence provided the basis for the treasury secretary’s empowerment. It reads:

“Decisions by the Secretary pursuant to the authority of this Act are non-reviewable and committed to agency discretion, and may not be reviewed by any court of law or any administration agency.”

In other words, unchallengeable czarist powers. In contrast to the 1930s Reconstruction Finance Corporation’s (RFC) closely supervised operations. That era’s Home Owners’ Loan Corporation (HOLC) that refinanced homes to prevent foreclosures. And the 1980s Resolution Trust Corporation (RTC) mandate to liquidate assets from failed S & Ls. Not dispense free money for bad investments unchecked. The above authorities subject to judicial review. Not governed by a financial boss to run as he pleased.

The Announced “Bailout” Deal – The Emergency Stabilization Act of 2008 (ESA)

According to The New York Times, EESA calls for “strict oversight of the program by a Congressional panel and conflict-of-interest rules for firms hired by the Treasury to help run the program.” Also “a change in the bankruptcy laws sought by some Democrats to give judges the authority to modify the terms of first mortgages.”

Given the bipartisan blame for today’s crisis. The post-9/11 willingness to give the administration near-carte blanche authority across the board. Eight years of indifference to social needs and public welfare. Who now believes that policy going forward will change and that the agreed-on scheme will protect people or curb the secretary’s authority. On his own initiative, George Bush usurped supreme power post-9/11 while few in Congress blanched. None in leadership positions. Little today has changed.

Disclaimers notwithstanding from both sides of the aisle, Wall Street is pleased. Paulson got what he wanted. The plan’s fine print will assure it. Public money. Far more, if needed, than $700 billion. The power to dispense it freely. With weak at best oversight and judicial review, and the ability to conceal fraud and malfeasance. In short, the between-the-lines meaning of Paulson saying: “We have made great progress toward a deal, which will work and be effective in the marketplace.”

The same one that fleeced the nation and betrayed the public trust. Now empowered to take more with the full faith and blessing of the government from both sides of the aisle. Belying George Bush’s insult that “The rescue effort….is not aimed at Wall Street; it is aimed at your street.” And Nancy Pelosi’s hypocrisy that: “All of this was done in a way to insulate Main Street and everyday Americans from the crisis on Wall Street….I want to congratulate all of the negotiators for the great work they have done.” Who in banker boardrooms would disagree.

Some Relevant Facts

Clearly the present crisis is unprecedented. As stated above, maybe it can be fixed and maybe not. No one is sure because no one understands it fully. Where all the problems lie. To what degree can they be contained. How great their fallout may be. Their full effect on world economies. How bad things may get before they stabilize and improve, and the way the world will look like when they do.

Whatever’s coming, industrial capitalism is eroding. A kleptocracy replaced it. If the system is saved, it will be temporary, and an even greater one will emerge. Why this article is called Grand Theft America. A criminal class runs it, and they’re rewarded for their crimes. Backed by the full faith and credit of the government with taxpayer money. A near-limitless amount created and borrowed. Who said crime doesn’t pay!

For over 30 years, an unimaginable wealth transfer to the rich has been ongoing. To the top 1% and corporate America from most others. It proves the failure of a system that rewards the few at the expense of the many. Licenses greed and creates this kind of global financial crisis so far uncontained. It begs the questions: what caused it and what’s the fallout:

— the ruinous effects of militarization; insane amounts of spending on it; “military Keynesianism;” believing capitalism thrives on foreign wars; “Global Wars on Terrorism” currently; their costs are unsustainable and are heading the nation toward bankruptcy;

— the drain on an already weakened economy;

— maxed out consumers now debt slaves;

— so is government from unrepayable obligations in the tens of trillions; not the fictitious “official” reported numbers;

— the possibility of future default; hyperinflation; national bankruptcy, and the demise of the republic;

— human default as well: mass bankruptcies; home foreclosures; rising unemployment; increased poverty; and growing numbers of families unable to survive;

— the subprime crisis is just part of it; seven million mortgages sold to the unwary; the idea was to criminally defraud them; offer two-year teaser rates; then reset them higher semi-annually based on an interest rate benchmark; payments soared as much as 30% and became unaffordable; the scheme was to cash in at the expense of mortgage holders, and five million risk losing their homes and life savings;

— an “economic Pearl Harbor” for Warren Buffett; for Senator Chris Dodd a “50-state Katrina;” a “house of cards (built on) reckless finance” for author Kevin Phillips; Frankenstein finance; casino capitalism; for most Americans, a human catastrophe;

— the demise of our manufacturing base; letting malls replace factories as the economy’s engine;

— permitting the financialization of the economy; speculative finance writ large; replacing productive investment; totally deregulated; run by fraudsters; free from government oversight; letting investment banks game the system at up to 40 to 1 leverage; until 2004, 12 to 1 was the maximum;

— a government – business conspiracy for global dominance and the single-minded pursuit of profit; unfettered amounts of it through cleverly manipulated schemes; transferring multi-trillions of dollars from workers to the most wealthy; doing it without people even noticing;

— creative destruction to let giant businesses grow larger by removing and devouring smaller ones; even large ones;

— permitting and/or ignoring massive fraud; involving multi-trillions of dollars; the largest ever Ponzi scheme; a calculated crime with media complicity through silence; not reporting a growing problem as it emerged; waiting until it mushroomed and still not explaining it accurately and honestly; and

— wondering won if the best and brightest can fix things or if no amount of money or ingenuity can do it.

The Plan’s Architect – Henry Paulson

From a Nixon administration staff assistant to the assistant secretary of defense. To assistant to key Watergate official John Erlichman. To Goldman Sachs in 1974. To a partnership in the firm in 1982. Then Chief Operation Officer (COO) in 1994 and CEO in 1998 by a palace coup against co-chairman and now New Jersey governor Jon Corzine, according to New York Times columnist Floyd Norris.

Even before the current crisis, Goldman was the preeminent Wall Street firm. A survivor. The largest, and along with Morgan Stanley, the remaining two Street giants left standing. But no longer as investment banks after the Federal Reserve’s September 21 announcement that both companies will become bank holding companies after a mandatory five-day waiting period, now over.

In theory, they’ll be under stricter Fed oversight but will get Fed help to complete their transition and thereafter. As a well-connected financial powerhouse, whatever Goldman wants, Goldman gets. Always in the past by recycling top executives into Democrat and Republican administrations, and now more than ever given Henry Paulson’s extraordinary financial czar powers.

Before his $700 billion giveaway plan, the 2008 Housing and Economic Recovery Act gave him authority to fleece taxpayers by rescuing Fannie Mae and Freddie Mac as well as raise the national debt by over $5 trillion dollars. He also orchestrated the demise of Bear Stearns, Lehman Brothers and Washington Mutual. The forced sale of Merrill Lynch, and arranged the government takeover of AIG.

He has near-open checkbook authority to reward close allies with loans and free money and let them acquire troubled assets on the cheap. This from a man with much responsibility for today’s crisis. A June 12, 2006 Business Week cover story titled “Mr. Risk Goes to Washington” called him “one of the key architects of a more daring Wall Street, where securities firms are taking greater and greater chances in their pursuit of profits.” Such as assuming huge amounts of debt and “placing big bets (with their own money) on all sorts of exotic derivatives and other securities.” Advising clients to do the same. Casino capitalism at up to 40 to one leverage. Hugely profitable in up markets. Disastrous in down ones.

Paulson earned millions and now has an estimated $700 million + net worth. For 2007 overall, according to Bloomberg.com, “Wall Street’s five biggest firms (paid out) a record $39 billion in bonuses (and did it in) a year when three of the companies suffered the worst quarterly losses in their history and shareholders lost more than $80 billion.”

Speculative finance pays well, even in down years, and it even raised Bloomberg’s ire in a Michael Lewis September 24 commentary titled “America Must Rescue the Bonuses at Goldman Sachs.” It reflected on a possible global financial collapse but sacrificing Goldman bonuses is another matter. If firm “employees (take) pay cut(s), it will be (tantamount to failure and) our country may never recover.” How will the company induce new talent to come aboard. Goldman is well-positioned to get maximum gain from its former CEO’s $700 billion handout.

Why else would Warren Buffett bet $5 billion on the firm! For preferred shares paying an annual 10% dividend. Warrants as well to buy $5 billion in common stock at a $115 a share strike price. Well off its $251 peak and below the latest September 26 $138 a share.

Joseph Stiglitz on the Economy

Stiglitz was formerly part of the system he now criticizes. Free market fundamentalism in its most extreme form. For many months, he warned about a worsening global economy and growing financial crisis that’s as bad or worse than the Great Depression.

He sees similar problems now as then:

— outsized speculation through excessive leverage;

— pyramid schemes;

— multiple bubbles through so-called Wall Street innovations; and

— a lack of transparency and government oversight.

Combined they created a crisis “so great that no one knows exactly the magnitude of the risk they face. It is particularly bad because our financial institutions are based on trust. You put money in the bank and you trust that you can get (it) out, so trust is absolutely essential for the functioning of our financial markets and economy.”

The problem is exacerbated by those providing the news. The dominant media and frequent spokespeople. Industry representatives like Lehman Brothers CEO saying last April that “we turned the corner, and the economy is on the uptick.” Also from the president, treasury secretary and others in government as things keep worsening.

Stiglitz calls this a “top down crisis.” The “$3 trillion cost” of foreign wars a key. Creating huge deficits and consuming vital resources needed for growth. “This is the first war in American history that has been totally financed on the credit card. For the last five years….we have been a debt economy.” Not since the Revolutionary War have “we have had to turn to foreigners,” so now “40% of our national debt is financed by (them). Even as we went (to war) we had a big deficit, and yet the president called for tax cuts for upper middle class Americans.” Insane but we did it.

Another factor is other countries trusting that our economy is working well, and when the president says it is he’s believable. “This administration burned that trust….no wonder everybody around the world is losing confidence.” Even worse is that the administration isn’t dealing responsibly with these problems, mostly because they’re of our own making.

Stiglitz worries about the “real economy:” home prices dropping; owners forced into foreclosure; more financial firms in crisis; and a good many won’t survive. He sees a weakening financial system unable or unwilling “to provide credit (the lifeblood of the economy for) loans, mortgages,” and that means lower home prices, contracting businesses, rising unemployment, and a “downward vicious cycle. You have to be in fantasy land to say that everything is fine (or even) that we have turned the corner.” He sees at least another 18 months of pain. Maybe longer. Who can know or how much.

For sure, real economic stimulus is needed. Productive investment. Not the phony “bailout” kind proposed. Aiding state and local governments. Better unemployment insurance and more for infrastructure. Providing a basis for long-term growth. Not feeding markets and starving the hungry, as one writer put it. Not believing markets on their own will fix things.

Understanding that government must intervene. Responsibly. Facilitate job creation. End casino capitalism. Provide incentives for real economic growth. Let foreclosed and threatened homeowners stay in their homes. Work out an equitable way to do it. “We learned a painful lesson in the 1930s and today: The invisible hand often seems invisible because it’s not there.” It led to the kind of predicament now confronting the country. The solutions proposed will just compound it.

Ones that Can Fix It

Good ones not considered. From figures like Dean Baker of the Center for Economic and Policy Research. Others as well with solid advice to:

— make fraudsters eat the bulk of their losses;

— use public funds only “to sustain the orderly operation of the financial system;”

— minimize speculative finance; the root of the current problem;

— “minimize moral hazard” – the Paulson (and Bernanke) “put” picking up where Greenspan left off;

— let delinquent homeowners stay in their homes and pay rent;

— curtail executive compensation for companies getting government aid;

— make a key Fed responsibility the prevention of asset bubbles; reinstitute regulations to do it; Glass-Steagall for starters that prohibited commercial and investment banks and insurance companies from combining;

— impose a modest financial transactions tax to curb excesses and raise revenue;

— trade assets, like credit default swaps, openly on exchanges to establish fair value for them;

— impose strict limits on leverage;

— keep Fannie and Freddie public institutions; their status before being privatized in 1968; and

— restructure the Fed democratically; a far better solution is abolish it and let government control its own money; use it responsibly for all Americans, not just the privileged few.

Other recommendations recognize no quick or easy solutions to problems this great. Economist James Galbraith says borrowers need collateral. A new Home Owners Loan Corporation to rewrite mortgages. Manage rental conversions, and decide what degraded properties should be demolished. Which ones to save and refurbish. Set it up in communities under federal guidelines and do it quickly. Help state and local governments strapped for cash. Reestablish federal revenue sharing. A National Infrastructure Bank making capital available for infrastructure. Put people to work building it. Protect seniors and near-retirees from wealth loss. Extra Social Security, Medicare and Medicaid revenue will help. Get money in the hands of people who’ll spend it.

Address other crucial issues like energy conservation, reconstruction and renewable power. Infrastructure overall. Tuition help for students. Another GI bill. Credit card and mortgage interest rate caps. Rescind anti-consumist laws like the misnamed 2005 Bankruptcy Abuse Prevention and Consumer Protection Act. A boon for credit card companies and other businesses. Unfairly burdensome to the public.

A whole range of other projects and ideas to redirect the economy away from speculative finance and militarism and toward high-return public investment. Do it before it’s too late. Recognize that the present course is unsustainable. Imagine a government working for everyone and not just the privileged few. Imagine it not tolerating fraud and malfeasance.

Instead, Congress agreed to a “bailout” and passed a record $634 billion omnibus spending bill (to run the government through March 6, 2009) to include a record Pentagon budget; $25 billion in low-interest auto industry loans; maybe with no provision for repayment; lifting a quarter-century ban on Atlantic and Pacific off-shore drilling; billions more in earmarked pork; and likely more coming later for the airlines and other endangered companies. Taxpayers for Common Sense criticized the bill at the same time it noted that government “bailout” appropriations will reach about $1.2 trillion with the $700 billion Paulson scheme. Others put the total above $1.5 trillion, and many say it’s only for starters.

Paying “hold-to-maturity” prices compounds the fraud. For securitized assets worth a fraction of full value. Much of it pennies on the dollar, if anything. Trillions of dollars of toxic ones. All sorts of them. Newly invented ones. Structured finance and insurance. Asset-backed securities. Repackaged into marketable pools. Sold to investors. It’s been done for decades but only recently so out of hand. Greed and deregulation created an alphabet soup of levered-up, high-risk securitized assets. Financial alchemy. Largely outright fraud, including:

— collateralized debt obligations (CDOs), including auto loans, credit and corporate debt;

— collateralized (asset-backed home) mortgage obligations (CMOs);

— commercial mortgage-backed securities (CMBS);

— mortgage-backed securities (MBS) and levered loans;

— structured investment vehicles (SIVs);

— special purpose vehicles (SPVs);

— pass-through securities;

— credit and interest rate default swaps;

— commercial paper and more;

— repackaged arcane stuff most people don’t understand; even investors who bought them; like eating a stew with no idea what’s in it; a recipe with no list of ingredients; learning too late it’s toxic and you’re in trouble;

Credit card companies as well from growing amounts of unrepayable credit card debt. The auto industry already assured of a low-interest $25 billion loan (or maybe handout) for starters. Airlines coming next. Select homebuilders and troubled companies called too big to fail. If they’re too big to fail, says one observer, they’re too big to exist.

EESA will give the treasury secretary near-carte blanche powers to conceal fraud and help the fraudsters, including his former company, Goldman Sachs, now in trouble. Pick and choose among others. Which will survive, and what less favored ones will go on the block at fire sale prices or disappear. Today there are 9000 banks in the country. In a decade, half or more of them may be gone.

Economist Michael Hudson calls EESA “cash for trash” and a “giveaway,” not a bailout. A “transfer of wealth to insiders.” A financial coup d’etat. The “largest and most inequitable (kind) since the (19th century) land giveaways to the railroad barons.”

In this case, socializing losses to let fraudsters “sell out all their bad bets.” Junk of all sorts: a stew of securitized assets, bad mortgages, car loans, credit card loans, student loans, anything for insiders stuck with too much of them.

A doomed scheme that will raise the debt level instead of lowering it. Enrich fraudsters with taxpayer funds. Stick the public with toxic junk. Maybe buy time before more people and markets catch on, but, in the end, cripple the economy and erode industrial capitalism with it.

Hudson is justifiably angry given the amount of fraud and deceit. The government-concocted scheme to whitewash it. Reward criminals. Harm most others, and wreck the country at the same time. He says a “kleptocratic class has taken over the economy to replace industrial capitalism….’banksers’ ” for FDR and earlier condemned by Jefferson with this stinging comment:

“I sincerely believe that banking institutions are more dangerous to our liberties than standing armies. Already they have raised up a money aristocracy that has set the government at defiance. The issuing power should be taken from the banks and restored to the people to whom it properly belongs.”

A half century later Lincoln said:

“I see in the near future a crisis approaching that unnerves me and causes me to tremble for the safety of my country….corporations (including bankers) have been enthroned and an era of corruption in high places will follow, and the money power of the country will endeavor to prolong its reign by working upon the prejudices of the people until all wealth is aggregated in a few hands and the Republic is destroyed.”

Lincoln refused to pay bankers usurious rates to finance the Civil War and got Congress to pass the 1862 Legal Tender Act. It empowered the US Treasury to issue “greenbacks” that were interest-free because government printed its own money. When Lincoln was assassinated in 1865, the “Greenback Law” was rescinded. A new national banking act was passed, and the government once again had to pay interest to bankers.

On June 4, 1963, President Kennedy issued executive order (EO) 11110 giving the president authority to issue currency. He ordered the treasury to begin printing “United States (Treasury) Notes” to replace “Federal Reserve Notes.” He began a process to let government control its own money and no longer private bankers under the guise of the Federal Reserve. Months later, Kennedy was assassinated. Once Lyndon Johnson took office, he rescinded EO 11110 and reestablished the current system. More on that below.

The Two Greatest Ever Financial Crimes – Today’s Fraud and the 1913 Federal Reserve Act’s Privatization of Money Creation

Most people think the Federal Reserve is a government agency, subject to its control. It’s sometimes mistakenly called a quasi-governmental decentralized central bank to disguise its real identity and purpose. Its Eccles building headquarters compounds the subterfuge. Below it’s stripped away.

The Federal Reserve is a private for-profit banking cartel. Owned and run by major banks and Wall Street in each of its 12 Districts. It was created and operates in violation of Article 1, Section 8 of the Constitution that states that Congress alone shall have the power to create money and regulate its value. In 1935, the Supreme Court ruled that Congress cannot constitutionally delegate this power to another authority, but, in fact it did.

On December 22, 1913, between 1:30 – 4:30 AM, the Federal Reserve Act was shepherded through a special Congressional Conference Committee. Then voted on and passed the next day. Two days before Christmas with many members gone and most others with no time to read or consider this momentous document.

By enacting this law, Congress and President Woodrow Wilson defrauded the public. Wilson later said (when it was too late to matter) he made a mistake and “unwittingly ruined my country.” This from a man who was an intellect. Trained in the law. A PhD in political science and president of Princeton University in his earlier years.

The Federal Reserve Act gives private bankers the most important of all powers. The one most of all that governments should never relinquish. The authority to print money. Control its supply. Its price through the Fed Funds rate and how it influences the whole yield curve. Loan it out for profit, and charge government interest on its own money. It’s later returned minus operating expenses and a guaranteed 6% profit. Taxpayers foot the bill. An early and continuing example of wealth transfer from the public to powerful bankers. Illegally sanctioned by Congress and the president.

The Fed literally creates money out of nothing. Expands or contracts its supply as it wishes – with no government oversight or control. Gold once backed it until Nixon closed the gold window in August 1971. Suspended dollar convertibility into the metal, and ended compliance with the Bretton Woods core provision. The US dollar became fiat currency. Mere paper. Backed by nothing except the faith of the issuing authority.

Given today’s crisis, that faith is fast eroding and is to blame for dollar weakness. Mostly because of profligate policies by private bankers running the country’s monetary policy for their own gain. The grandest of grand thefts along with today’s all-consuming fraud. Backed by the full faith and credit of the government, and up to now at least, with most people none the wiser.

A Growing Public Response to the Crisis

For how long is the question given growing public anger and people expressing it publicly. It has administration officials worried enough to order what Michel Chossudovsky wrote in his September 26 article titled “Pre-election Militarization of the North American Homeland.”

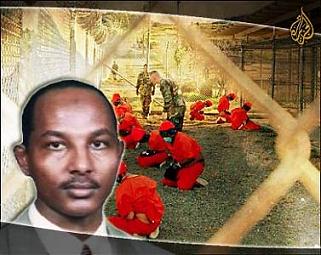

He cites an Army Times article saying that the 3rd Infantry’s 1st Brigade Combat Team is coming home (in October) from Iraq as (according to the Times) “an on-call federal response force for natural or manmade emergencies and disasters, including terrorist attacks.” Perhaps with a manufactured incident as pretext. To defend the homeland against ourselves. Be deployed against dissent. Erupting public anger. On city streets like in Denver and St. Paul. Displaying civil disobedience. Defiance against fraud, deceit, illegal foreign wars, and nearly eight intolerable years under George Bush and a complicit Congress. Capped by the current financial crisis touching everyone while government rewards crime and hangs its victims out to dry.

The 3rd Infantry’s 1st Brigade is for combat. It’s not the National Guard or local police. It’s trained for war. “Equipped to kill people” with potent weapons, and a last hurrah scheme may be planned to divert public attention from the financial crisis. A “terrorist” attack with “chemical, biological” or other dangerous weapons. A possible pretext for martial law at a time the administration and Congress are vulnerable. When people are angry about Washington protecting the privileged. Partnering with them in crime. Defrauding the public and stifling dissent. Moving one step closer to tyranny and away from silly notions about democracy. Proving crime indeed does pay and awfully well on Wall Street. “It’s the economy, stupid.” Theirs, not ours.

KABUL: The Taliban have been engaged in secret talks about ending the conflict in Afghanistan in a wide-ranging “peace process” sponsored by Saudi Arabia and supported by Britain, The Observer has revealed.s

KABUL: The Taliban have been engaged in secret talks about ending the conflict in Afghanistan in a wide-ranging “peace process” sponsored by Saudi Arabia and supported by Britain, The Observer has revealed.s